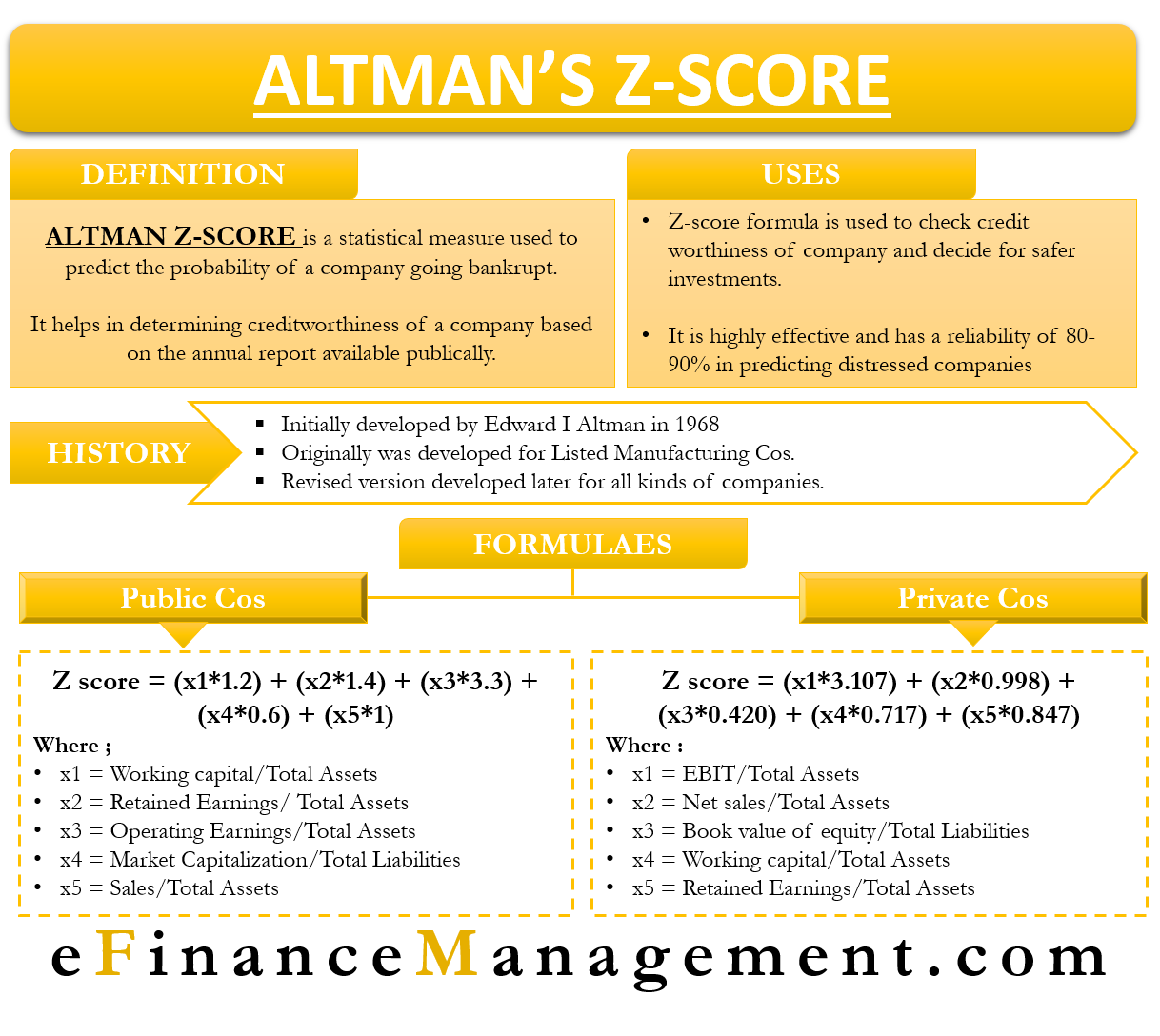

You can also check out our total asset turnover calculator. Here is a Z-Score calculator for those who want to figure the calculation. The last ratio to calculate is the sales/TA ratio, which measures a company's ability to generate revenue. The Altman Z-Score is a formula of 5 basic financial ratios to help determine. MVE/TL = ($20 * 1,000,000) / $20,000,000 = $20,000,000 / $20,000,000 = 1.0. The calculation takes the sum of a few financial/business ratios, weighted by coefficients, and the final score puts the company in one of 3 zones: bankrupt. In our example, Company Alpha's MVE/TL ratio is: MVE = share price * number of shares outstanding The Altman z-score formula used to predict the probability that a firm will go into bankruptcy within two years. This ratio tells you about the company's leverage. You can also use our ebit calculator to calculate the EBIT.Ĭalculate market value of equity / total liabilities ratio Altman Z Score Calculator - Have you ever doubted an investments future Have you ever missed an investment opportunity just because you are afraid that. The next ratio to calculate is the EBIT/TA ratio and it measures a company's profitability. RE = net income - dividend per share * number of shares outstanding The RE/TA ratio measures the accumulated profitability of a company and you can calculate it using the formula below: The Altman Z-Score gauges a manufacturing companys probability of bankruptcy.

#Altman z score calculator how to

How to Calculate an Altman Z-Score - Investopedia. NWC/TA ratio = ($200,000 + $300,000 - $100,000) / $50,000,000 = $400,000 / $15,000,000 = 0.008.Ĭalculate retained earnings / total assets ratio These notes should be read either before or after using the Financial Risk Calculator: Remember that nothing is sacrosanct and things keep changing over. what is altman z score mean Predicting Vendor Financial Viability in a SaaS world. NWC = accounts receivable + inventory - accounts payable

The NWC can be calculated using the formula below: This ratio measures the short-term liquidity risk of a company and is calculated as: The whole process takes 6 steps:Ĭalculate net working capital / total assets ratio The formula for Altman Z-Score is 1.2(working capital / total assets) + 1.4(retained earnings / total assets) + 3.3(earnings before interest and tax / total.

We need to calculate 5 ratios to compute the Altman Z-Score. Number of shares outstanding: 1,000,000 Calculating Altman Z Score- A mathematical model that uses a combination of 5 ratios to predict the probability of business failure of a publicly traded firm.Company Alpha reports the following information: The Altman Z-Score calculator will retrieve data from the internet and calculate the Altman Z-Score automatically The only thing you need to do is enter the company ticker from the stock you want to calculate the Z-Score of. Some of the information here is exclusively for iSaham clients only.Let's take Company Alpha as an example to help us understand the concept of the Altman Z-Score in our Altman Z-Score calculator. This is the equivalent of referencing a z-table. Raw Score, x Population Mean, Standard Deviation, Z-score and Probability Converter Please provide any one value to convert between z-score and probability. The information provided here is not, and must not be construed to be, or form part of, any recommendation, offer or invitation to buy or sell any securities. Z-score Calculator Use this calculator to compute the z-score of a normal distribution. Add to Favoritesĭisclaimer: Use of the information herein is at one's own risk. Z-scores are used to predict corporate defaults and an easy-to-calculate control measure for the financial distress status of companies in academic studies. Altman Z Screener Last Updated: Fri, 17:01:02Ĭontributor: Nik Khalili.

0 kommentar(er)

0 kommentar(er)